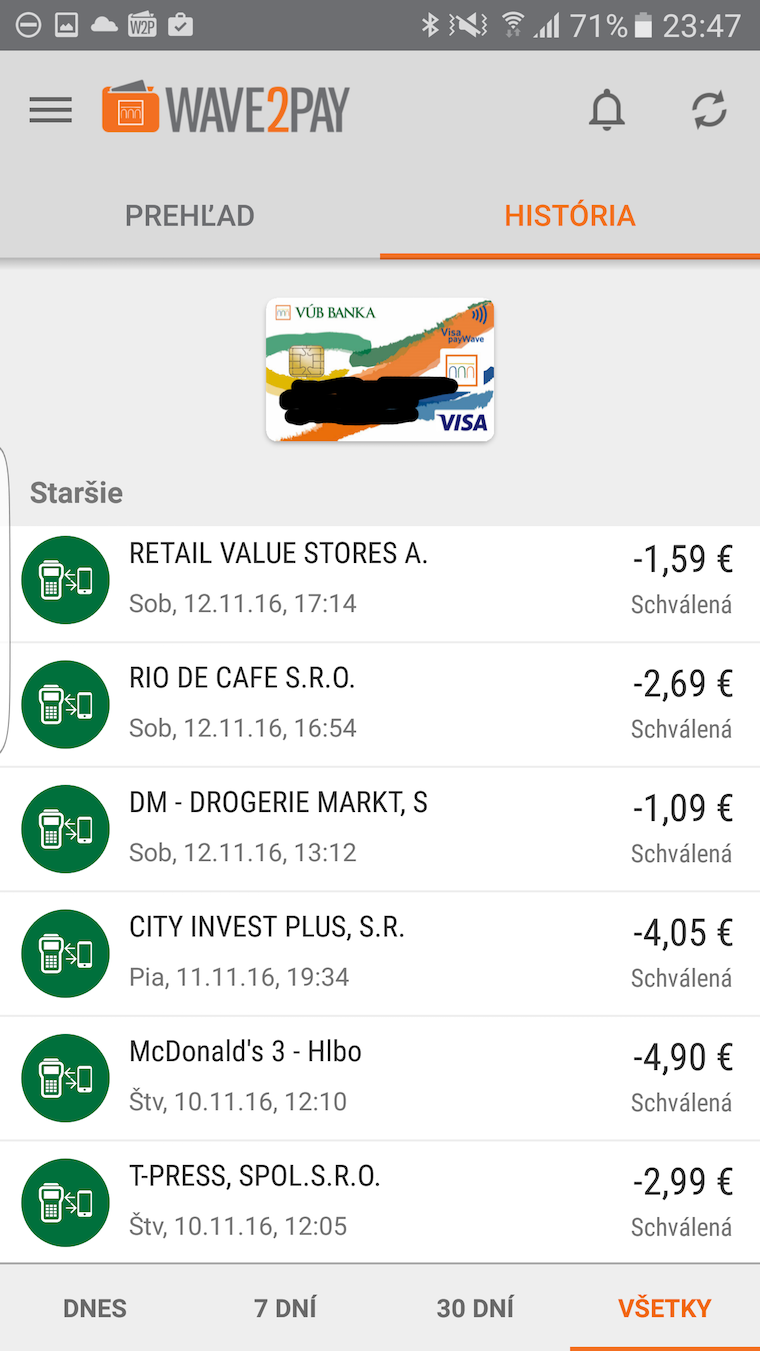

It has been possible to pay with a mobile phone for a few years now, but it is still not a very widespread function. At the same time, it is a very convenient payment method, which is possibly even faster than paying with a dedicated contactless card. To pay, you need a mobile phone with NFC, a data connection (or WiFi) and an application from your bank. The advantage is that these applications also offer a desktop widget with which you can immediately activate the given payment system.

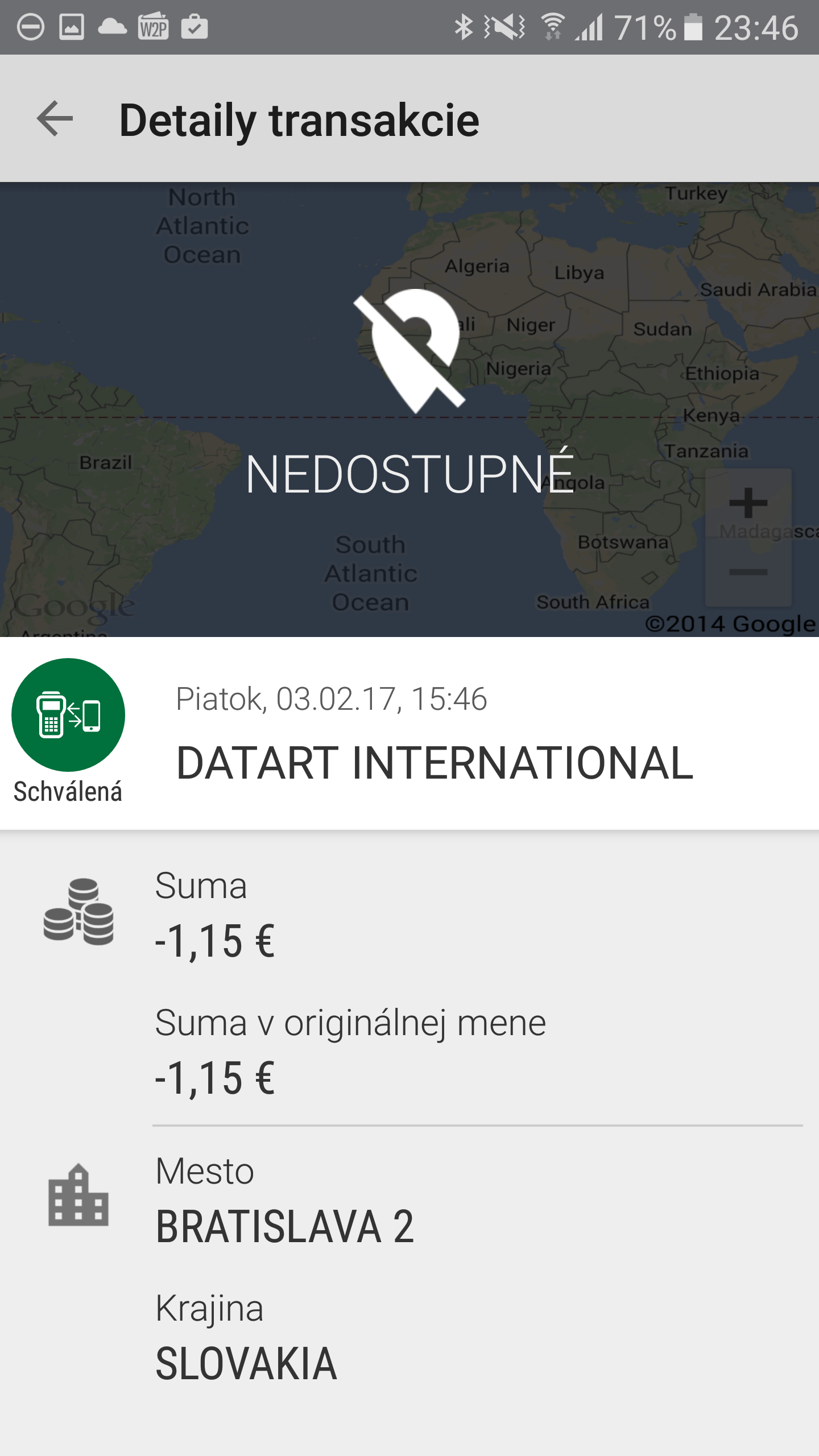

However, the systems will not allow you to use your current payment cards, at least not in the case of VÚB. To be able to pay contactless, you must activate the service at the bank. It starts with a visit to the bank, where you request to make mobile payments available and sign the relevant documents. What you basically get is a virtual payment card that is linked to your bank account and works independently of your regular card.

In the case of VÚB banka, it is their service Wave2Pay charged, €5 per year. So quite a negligible amount. Of course, the first fee is charged the moment you activate the service at the bank. Then you just have to wait some time (in my case it took about 2 hours) until you receive an SMS with an activation code that you must enter in the Wave2Pay application to activate it. You have 24 hours to activate. You also need to create a PIN code that the app will require for payments. Then you have to wait some time and you can start paying with your mobile phone!

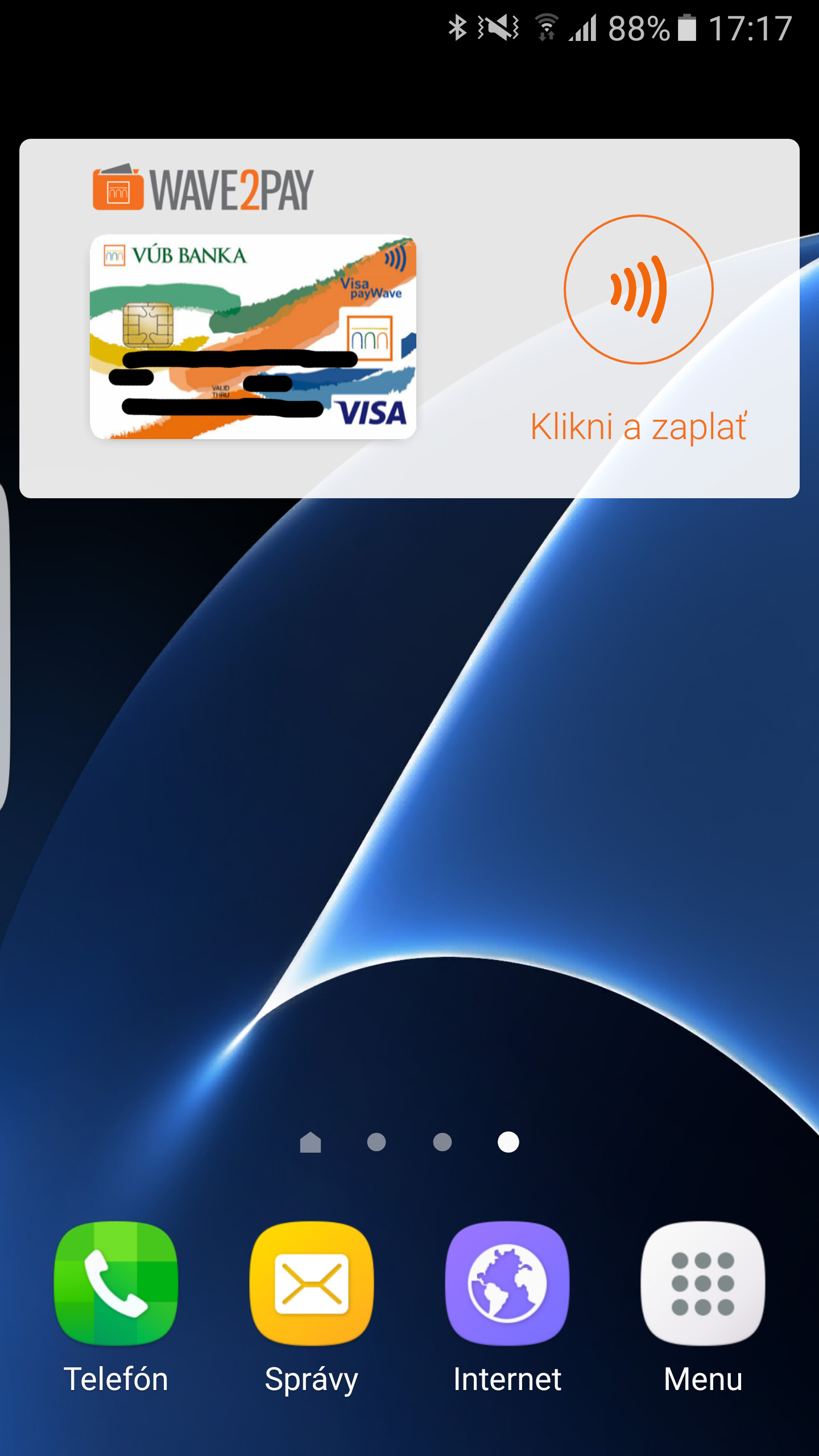

You then have to add the widget to your desktop, it occupies two rows of icons on the desktop. Then press the button to pay Click and pay, while for verification the mobile will ask for the PIN code from the card, which you set during the initial application settings.