Commercial message: Modern technology and alternative approaches have disrupted many customs in the financial world. One such alternative investment is, for example, P2P loans, which make it possible to bypass classic institutions with their claims and fees.

An example of a P2P platform is for example Czech Bondster, which essentially functions as a marketplace and intermediary between lenders and investors. Here you can invest your free money in loans according to your criteria, e.g. highest yield, type of loan, etc.

A distinctive feature of the Bondster is the desire to do better securing loans, which he wants to attract more cautious investors. How Bondster achieves this:

- Part of the loans are secured by real estate or other assets

- It provides for part of the loans buyback in case of default

After matching your investment with a specific loan, the platform operator takes care of everything. You get installments with interest directly from Bondster. Guarantees and insurance policies are a welcome parameter among investors, as a certain percentage of non-paying borrowers is a common reality in this segment.

On the other hand, interesting things can be achieved by borrowing money appreciation of up to 15% per year.

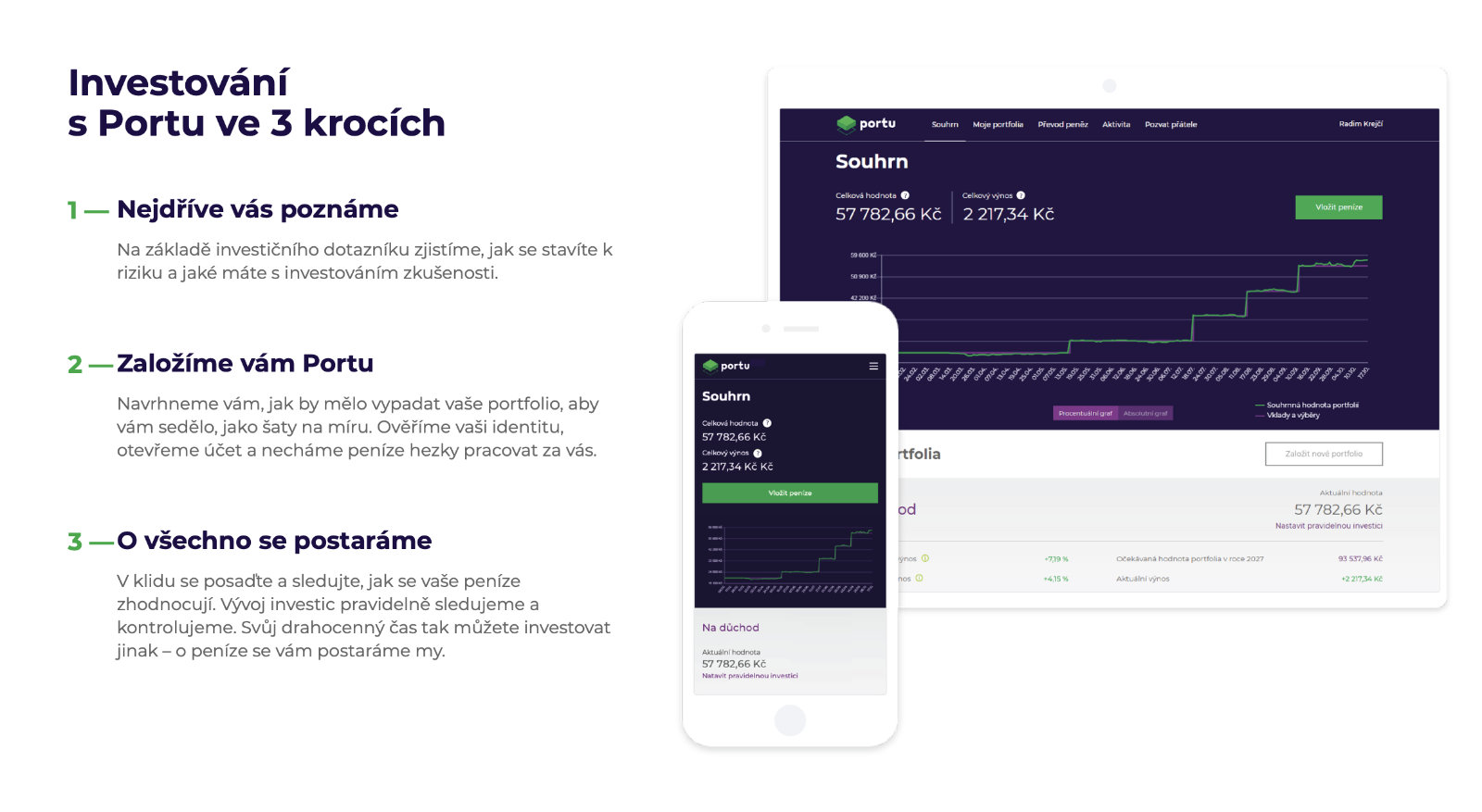

Customized portfolio and professional asset management

Are you more attracted to traditional investing in securities? For a small cost, you can have a so-called customized portfolio created and managed.

He has this in his repertoire Port service, which offers long-term investing using stocks and ETFs. You choose the composition of the portfolio and the strategy yourself based on your personal preferences. Portu then takes care of all its administration for you.

The biggest added value for retail investors is broad diversification. With little capital, it is difficult to buy stocks all over the world.

Portu uses the concept of so-called fractional shares. Thanks to them, assets across the planet can be purchased at a fraction of the cost.

You can invest meaningfully with Portu starting from CZK 1000 HERE

Main advantages:

- Portu sets up and manages the investment strategy according to your preferences

- Diversified portfolio even with small capital

These platforms are especially suitable for beginners or passive investors who are willing to pay professionals for portfolio management. The advantages of Port prevail even when investing with a really small capital. You can start with just a thousand and gradually increase the capital in small amounts.

Innovation in technology cannot always guarantee better returns. But they can offer equal access to segments that previously belonged only to mobile individuals. An example is precisely P2P loans, which open wide possibilities to bolder investors without the right to millions of capital and background.

Tailor-made portfolios, on the other hand, fill the gap between bank savings and shares. In this way, even people who do not have a lot of free funds or do not have confidence in their own investment judgment can get into long-term investing in securities.

Investing in Porto is not without risk. Historical returns are not a guarantee of future returns.

- Try it customized portfolio or P2P investment.

Discussion of the article

Discussion is not open for this article.