A mortgage is a great tool (not only) on the way to owning your own home. However, the majority of Czechs repay it for at least 20 years, during which there may be several great opportunities to negotiate a better interest rate. In the end, practically everyone has the opportunity to save on interest. It is in this respect that the so-called refinancing plays an extremely important role. But there is a small catch. One must not miss the right moment, and on the contrary, one must keep an eye on one key date - the end of fixation.

Mortgage refinancing

As we mentioned above, if you want to save as much as possible on your mortgage, then refinancing plays a fairly important role. In that case, you will repay your debt with the existing bank with a newly negotiated mortgage with another bank. This is a completely common and safe practice to deal with rising interest. At the same time, this option also brings other benefits. In addition to the interest, the mortgage can be increased, extended or, conversely, shortened.

The whole thing has only one condition. Just look at the mentioned deadline for the end of the fixation and start solving the entire refinancing process before it expires. In such a case, of course, several possible procedures are offered. Either you can act on your own, or you can rely on the power of modern technology and make the whole process easier. Moreover, right now is the most suitable opportunity for refinancing. If you took out a mortgage four to five years ago, then refinancing is literally a must. Interest rates are at a completely different level right now, which can make your wallet uncomfortable. A simple question therefore arises. How to prevent this?

Mortgage Watcher

A popular web application is offered as a proven solution hyponamíru.cz. Behind it is a Czech fintech startup that specializes in mortgages, their refinancing and management. This service significantly exceeds the possibilities of available alternatives and specifically brings a number of options to people, from the very arrangement of the mortgage, through its "guarding" and management, to real estate valuation. It is therefore not just a mortgage calculator, but a comprehensive solution with a number of other advantages. The best part, of course, is that you can solve practically everything from the comfort of your home.

An important part of hyponamíru.cz is a function called Mortgage Watcher, which serves to monitor important deadlines and subsequently facilitate refinancing. For mortgage refinancing, it is important that you inform your bank about this step at least 30 days before the expiry of the fixation they informed. Therefore, it is appropriate to start solving the whole matter in time, at least two months before the end of the aforementioned fixation. The Mortgage Watcher will inform you about all this in good time, which will also help you with the best possible settings. Online mortgage banking is the center of everything happening at hyponamíru.cz. So you can clearly see everything directly on the screen, including the stage you are in with refinancing your mortgage.

In such a case, the web application will take care of everything directly - from timely information and finding the best offer, to the preparation of the necessary documents and the subsequent application. But let's quickly shed some light on the whole process. First you need to head to mortgage calculators for refinancing, where you only need to fill in the essentials informace. At the same time, it is important to choose here whether we want to solve the refinancing online with a bonus, or so-called old age with the use of an adviser. To solve everything online, we click on the first option. Subsequently, however, we move to mortgage banking, where all offers are displayed, which can still be sorted according to preferred parameters, for example according to the amount of interest.

If you're paying off your mortgage and you're nearing the end of your fixation, you definitely shouldn't procrastinate. Given the current level of interest rates, it is appropriate to arrange refinancing in time. On the other hand, you don't have to wait unnecessarily until the mentioned date. You can immediately a completely free park under the wings of hyponamíru.cz and let Hlídáč hótéky take care of practically everything for you. At the same time, you will get a number of other great benefits - because you can solve everything from the comfort of your home, with the help of real professionals, and be sure that you will not miss any favorable offer or important deadline. Simple mortgage banking, which is the center of all the action, plays an extremely important role in this. Hyponamíru.cz also emphasizes overall security and privacy. All user data is therefore maximally secure.

Get your mortgage refinanced online here

Property valuation

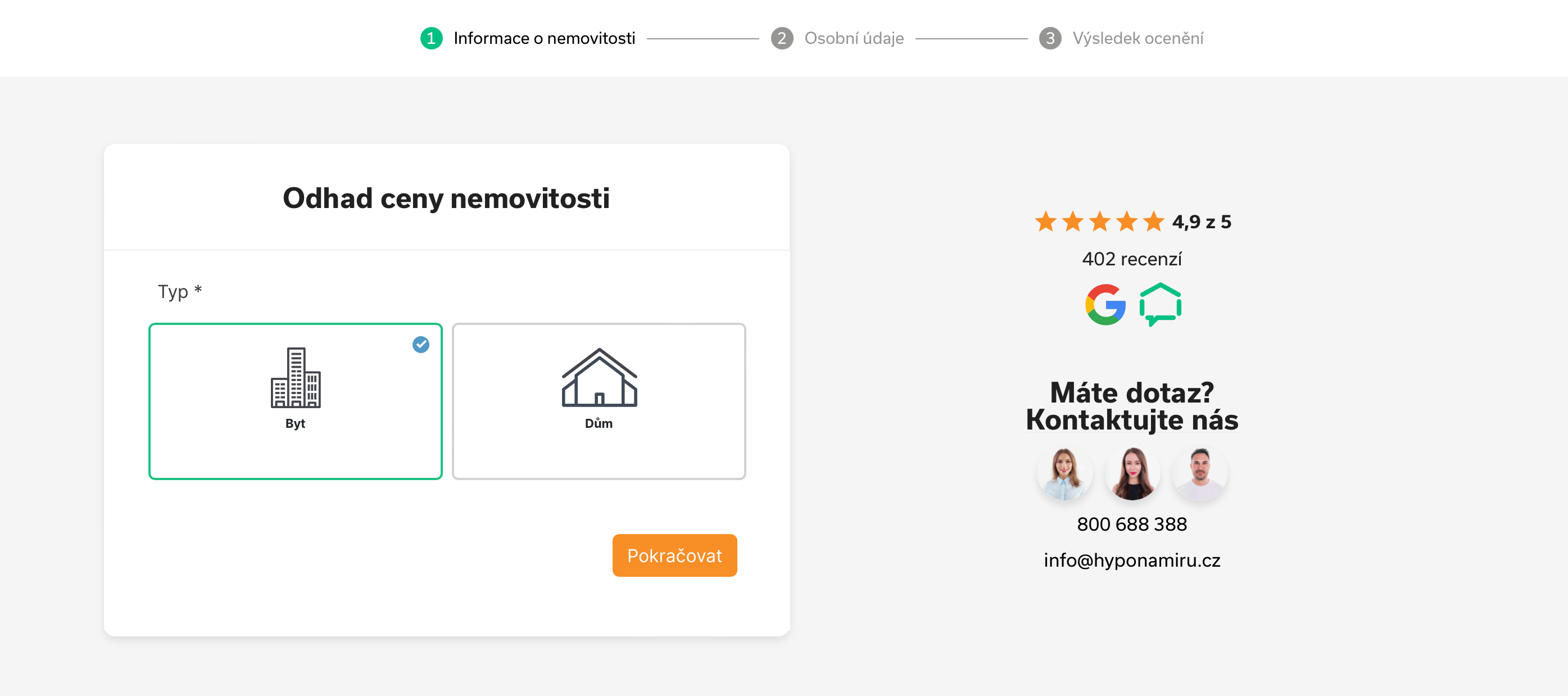

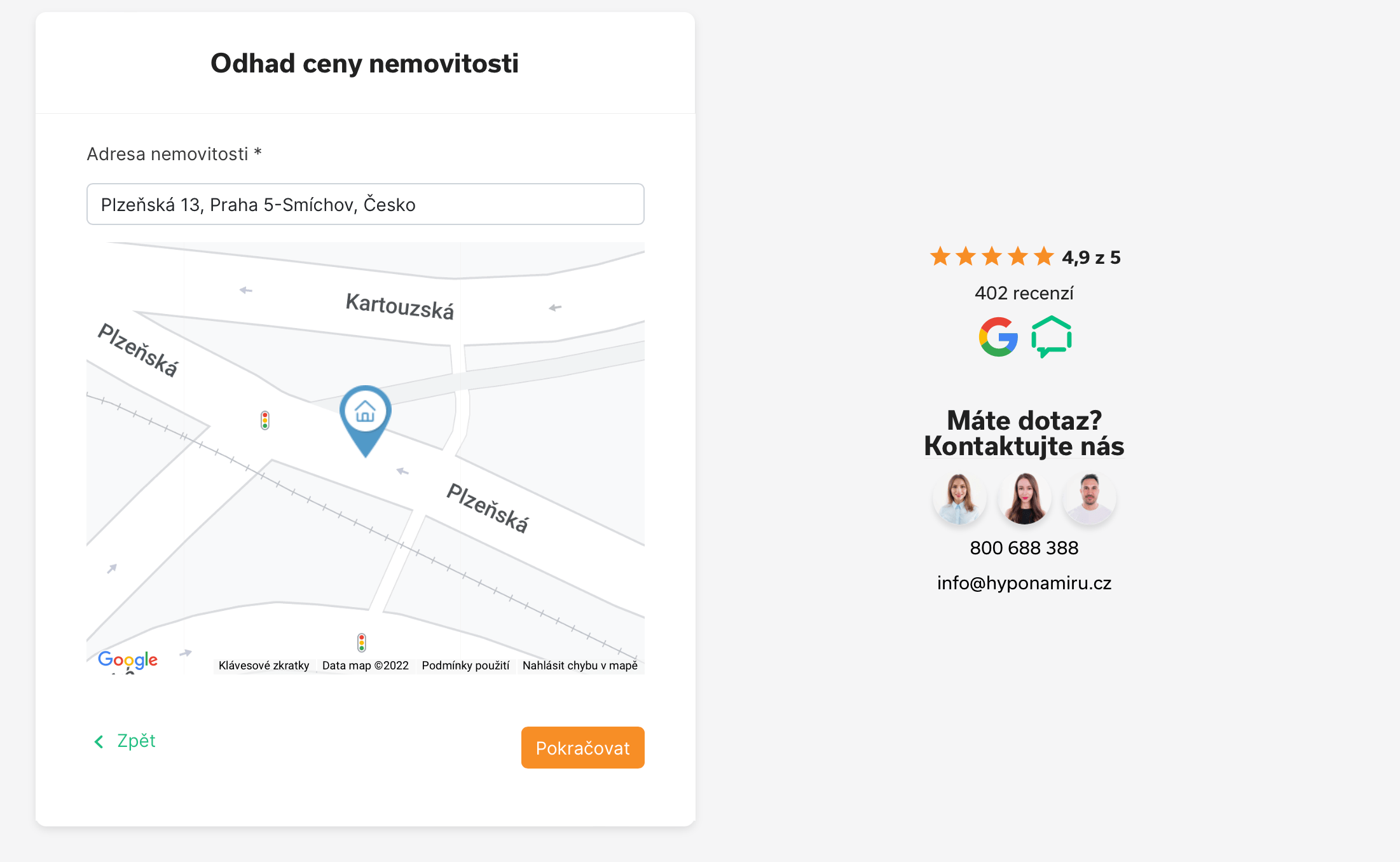

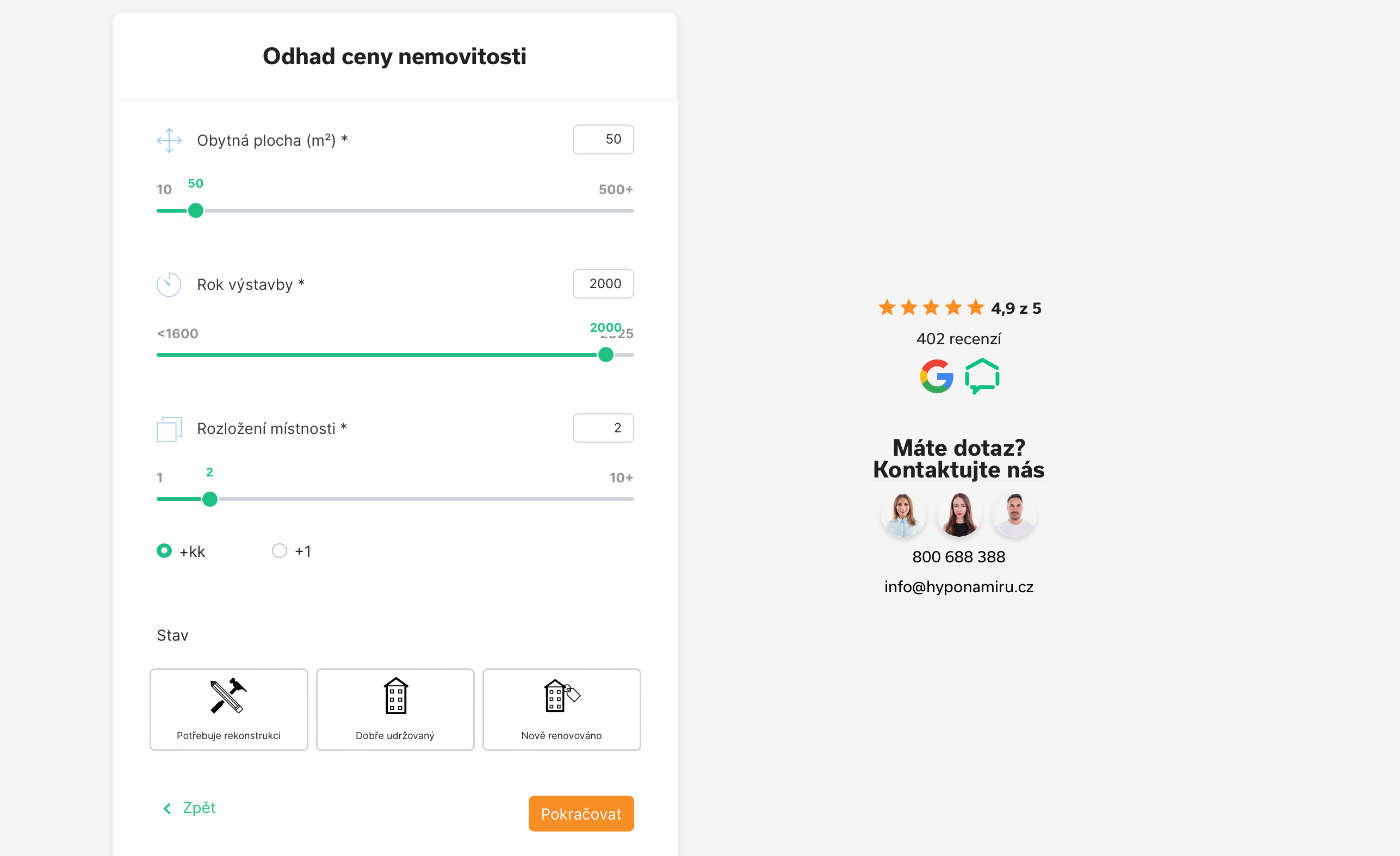

In addition to the mortgage calculator and mortgage watcher, the hyponamíru.cz online solution offers one more essential function. We are talking about a special module for real estate price estimate, which will come in handy for both sellers and buyers. In this case, the software works with an external seamcartechnology for the most accurate estimate, which is supplemented by available data from current and historical offers on the largest real estate portals in the Czech Republic, data from the real estate cadastre and the possibilities of artificial intelligence.

Everyone can check the real estate price online very quickly and easily, directly from the internet browser. This is therefore a perfect option both for the seller of the property and, conversely, for the interested party, who can find out the estimated price and immediately compare whether the current price is not excessive. As is usual at hyponamíru.cz, great emphasis is placed on simplicity and overall comfort in this case as well. In the first stage, you only need to choose whether it is an apartment or a house, fill in the necessary data (living area, number of rooms, year of construction, condition, etc.) and then just enter personal data in the form of name and e-mail, to which you estimate arrives.

You can find out the real estate price estimate here

About hyponamíru.cz

Hyponamíru.cz presents a great and, above all, comprehensive solution that can take care of setting up, managing or refinancing a mortgage. As we have already mentioned, the biggest benefit is overall comfort. Practically everything can be solved from the comfort of your home. Transparency is also extremely important. Every user has a detailed overview of all important things directly in mortgage banking, including, of course, fees, interest rates and more. The entire solution is directly supported by a team of experienced mortgage specialists. They participate in the very growth of the platform and ensure that everyone can get the most favorable mortgage possible without unnecessary obstacles.

Dealing with a mortgage or its refinancing is not exactly the easiest. That's why it certainly doesn't hurt to have an experienced partner on hand to guide you through the entire process. However, Hyponamíru.cz takes it one level further - it brings necessary awareness to the Czech environment. Specifically, he produces a podcast For a better mortgage and mortgage news HypoNews on Youtube. These are mostly shorter programs in which mortgage specialists talk about important facts that are good to know in advance.

Discussion of the article

Discussion is not open for this article.